Are you an accountant feeling overwhelmed by endless tasks that steal time from your core work? Imagine having a reliable helper who handles routine duties, so you can focus on what matters most—growing your business and serving your clients better.

A virtual assistant for accountants could be the game-changer you need. You’ll discover how this smart solution saves you time, reduces stress, and boosts your productivity. Keep reading to find out how to make your accounting work smoother and more efficient starting today.

Credit: 20four7va.com

Role Of Virtual Assistants In Accounting

Virtual assistants play an important role in the accounting field. They help with many routine tasks. This support allows accountants to focus on more complex work. Virtual assistants work remotely, saving time and costs for accounting firms.

These assistants have skills in data entry, organization, and communication. They keep financial records accurate and up to date. Many accounting tasks require careful attention, which virtual assistants provide.

Key Tasks Handled By Virtual Assistants

Virtual assistants manage tasks like data entry and bookkeeping. They prepare invoices and track payments. Scheduling appointments and managing emails are common duties. They also help with payroll and tax document preparation.

These tasks reduce the workload of accountants. Virtual assistants use software to keep financial data organized. They help maintain client records and financial reports. This support improves overall office efficiency.

Benefits For Accounting Professionals

Virtual assistants save accountants valuable time. Accountants can then focus on analysis and advising clients. Virtual assistants lower office costs by working remotely. They provide flexible help during busy periods.

These assistants improve accuracy by reducing errors in data entry. They also help keep deadlines on track. Accountants get more time to grow their business. Virtual assistants make day-to-day accounting smoother and easier.

Credit: ossisto.com

Time-saving Automation Features

Virtual assistants offer many time-saving automation features for accountants. These tools help reduce manual work and increase efficiency. Accountants can focus more on analysis and client advice. Automation handles repetitive and time-consuming tasks quickly and accurately.

Automating Data Entry And Bookkeeping

Data entry takes up much of an accountant’s day. Virtual assistants automate this by extracting data from receipts, invoices, and bank statements. This cuts down errors and speeds up bookkeeping. The system organizes transactions and updates ledgers automatically. Accountants save hours that usually go into manual input.

Streamlining Invoice And Payment Processing

Sending invoices and tracking payments can be slow and complex. Virtual assistants generate invoices based on client data and send them automatically. They also monitor payment status and send reminders for overdue bills. This smooth process ensures faster cash flow and fewer missed payments. Accountants spend less time chasing payments and more on client needs.

Improving Accuracy And Compliance

Accuracy and compliance are vital for accountants. Mistakes can cause big problems. Virtual assistants help keep numbers right and rules followed. They support accountants by handling routine tasks with care and precision.

Virtual assistants check data carefully. They catch errors before they cause trouble. They also stay updated with the latest rules and laws. This helps accountants avoid penalties and fines.

Reducing Human Errors

Virtual assistants reduce mistakes by automating calculations and data entry. They follow set instructions without missing details. This lowers the risk of errors caused by tiredness or distraction. Accountants can trust the numbers are accurate. It saves time on fixing errors later.

Ensuring Regulatory Compliance

Virtual assistants track changing tax laws and accounting standards. They remind accountants about important deadlines and reports. This helps keep all work within legal limits. Compliance reduces risks of audits and fines. Accountants can focus on advising clients, not chasing rules.

Boosting Productivity With Virtual Support

Virtual assistants help accountants work faster and better. They handle many tasks, so accountants can focus on important work. This support saves time and reduces stress. Accountants finish their jobs with less hassle.

Managing Schedules And Client Communication

Virtual assistants keep calendars organized and up to date. They set meetings and remind about deadlines. This stops double bookings and missed appointments. They answer client emails and calls quickly. Clients get fast responses, which builds trust and satisfaction.

Organizing Financial Documents Efficiently

Virtual assistants sort and file financial papers neatly. They use software to keep records easy to find. This saves time when looking for invoices or reports. Accountants spend less time on paperwork. They find data fast to make better decisions.

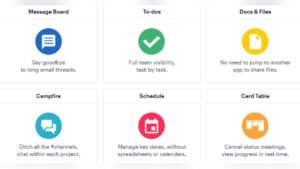

Choosing The Right Virtual Assistant Tools

Choosing the right virtual assistant tools can save accountants time and effort. These tools help manage tasks and organize work efficiently. Picking software that fits specific accounting needs is essential. The right tool can improve productivity and reduce errors.

Popular Virtual Assistant Software For Accountants

Many virtual assistant tools suit accountants well. QuickBooks Assistant offers voice commands for financial queries. Xero’s smart assistant helps with invoicing and reminders. FreshBooks includes automation for expense tracking. Some tools focus on calendar management, like Clara Labs. Others, like Google Assistant, integrate well with multiple apps. Each tool has unique strengths for different tasks.

Key Features To Look For

Choose tools with strong security to protect client data. Automation capabilities reduce manual work and save time. Integration with accounting software is very important. The tool should support voice commands and simple instructions. Easy-to-use interfaces make learning faster. Reliable customer support helps solve issues quickly. Customizable settings allow fitting the tool to your workflow. Look for tools with good reviews from accountants.

Credit: www.prialto.com

Case Studies Of Successful Implementation

Virtual assistants help accountants save time and reduce errors. Many firms have tested these tools and shared their results. Their stories show how virtual assistants improve workflows and client service.

Small Firm Success Stories

A small accounting firm cut data entry time by 40%. The virtual assistant handled routine tasks like invoice processing and appointment scheduling. Staff focused more on client advice and complex tasks.

Another small firm used a virtual assistant to track deadlines. This helped reduce late submissions by 25%. Clients noticed quicker responses and better communication.

Enterprise-level Improvements

A large accounting company integrated virtual assistants across departments. This reduced manual errors by 30% and sped up report generation. Teams collaborated better with easy access to shared data.

Global firms used virtual assistants to manage thousands of transactions daily. Automation lowered costs and improved accuracy. Staff worked on strategy instead of repetitive tasks.

Frequently Asked Questions

What Tasks Can A Virtual Assistant Handle For Accountants?

A virtual assistant can manage scheduling, data entry, invoicing, client communication, and bookkeeping support. They help streamline daily tasks, allowing accountants to focus on core financial analysis and client advising.

How Do Virtual Assistants Improve Accountant Productivity?

Virtual assistants save time by handling routine tasks efficiently. This reduces administrative workload, enabling accountants to meet deadlines and concentrate on complex accounting work and strategic planning.

Are Virtual Assistants Cost-effective For Accounting Firms?

Yes, virtual assistants reduce overhead costs by eliminating the need for full-time staff. They offer flexible support, making accounting firms more scalable and budget-friendly without compromising service quality.

What Skills Should An Accountant’s Virtual Assistant Have?

An ideal virtual assistant should have strong organizational skills, familiarity with accounting software, attention to detail, and excellent communication. Knowledge of financial terminology is also beneficial for accuracy and efficiency.

Conclusion

Virtual assistants help accountants save time and reduce stress. They handle routine tasks quickly and accurately. Accountants can focus on important work and clients. Using a virtual assistant improves productivity and organization. It also lowers the chance of errors in accounting.

Many firms find this support valuable every day. Try adding a virtual assistant to your workflow. Small changes can lead to better results and less hassle. Simple and smart—virtual assistants make accounting easier.

Ms.Sultana brings over 16 years of expertise working with global Clients by providing different skills and Services. For the last 5 years working as an Affiliate marketer, specializing in high-ticket campaigns that drive exponential growth. She holds a degree in Computer Science and Engineering as well as achieved many more skills certificates from different institute/academies/Platform. As part of the Elite Global Marketing team, Sultana has helped clients generate millions in revenue through strategic partnerships, innovative funnels, and data-driven insights.