A virtual assistant for bookkeeping handles your books remotely, fast, and at a fraction of in-house cost.

I have managed bookkeeping teams and hired remote talent for small businesses. In this guide I explain how a virtual assistant for bookkeeping can save time, cut costs, and keep your numbers clean. You will get clear steps to hire, tools to pair, security checks, onboarding tips, and real lessons from the field. Read on to learn how to use a virtual assistant for bookkeeping to free your time and grow your business.

Why hire a virtual assistant for bookkeeping?

A virtual assistant for bookkeeping gives you daily support without a full-time hire. This model blends skilled help with flexible hours. Small businesses and founders use it to close books faster and stay tax-ready.

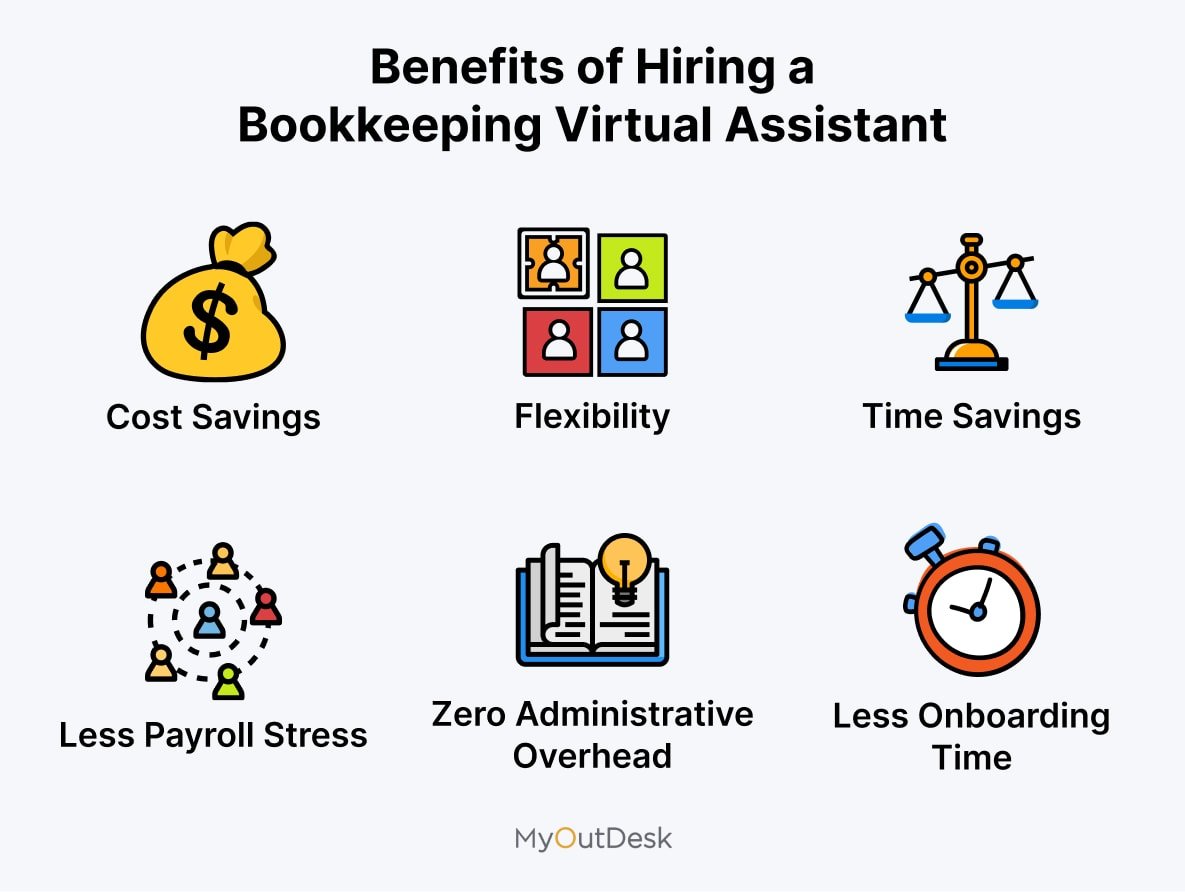

Benefits you can expect:

- Lower overhead and no office costs.

- Faster month-end close and clearer cash flow.

- Access to diverse skills like reconciliations, payroll, and invoicing.

- Scalability—add hours when you need them.

- Focus on growth while someone keeps your books tidy.

A virtual assistant for bookkeeping can be the bridge between messy receipts and clean financial statements. They free you to sell, lead, or build.

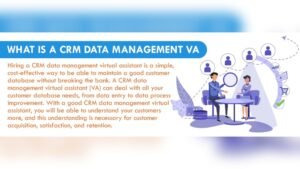

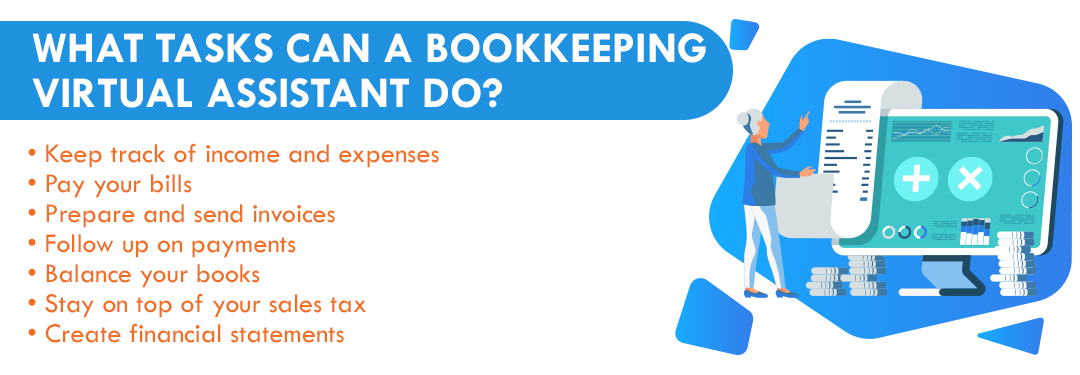

What tasks can a virtual assistant for bookkeeping do?

A virtual assistant for bookkeeping covers many routine and recurring tasks. They handle the day-to-day so you get accurate numbers on demand.

Common tasks:

- Bank and credit card reconciliations — find and fix mismatches.

- Accounts payable and accounts receivable — manage bills and invoices.

- Payroll data entry and basic payroll runs.

- Expense categorization and receipt management.

- Monthly close support and preparing trial balances.

- Sales tax prep and support for returns.

- Financial report generation — profit and loss, balance sheet.

- Clean-up work — fix past errors and reclassify accounts.

You can assign routine tasks and reserve complex items for your CPA. A virtual assistant for bookkeeping is ideal for steady, repeatable work.

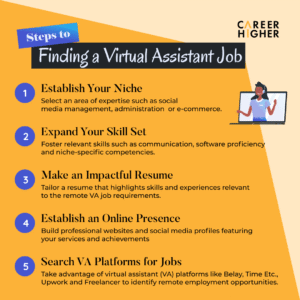

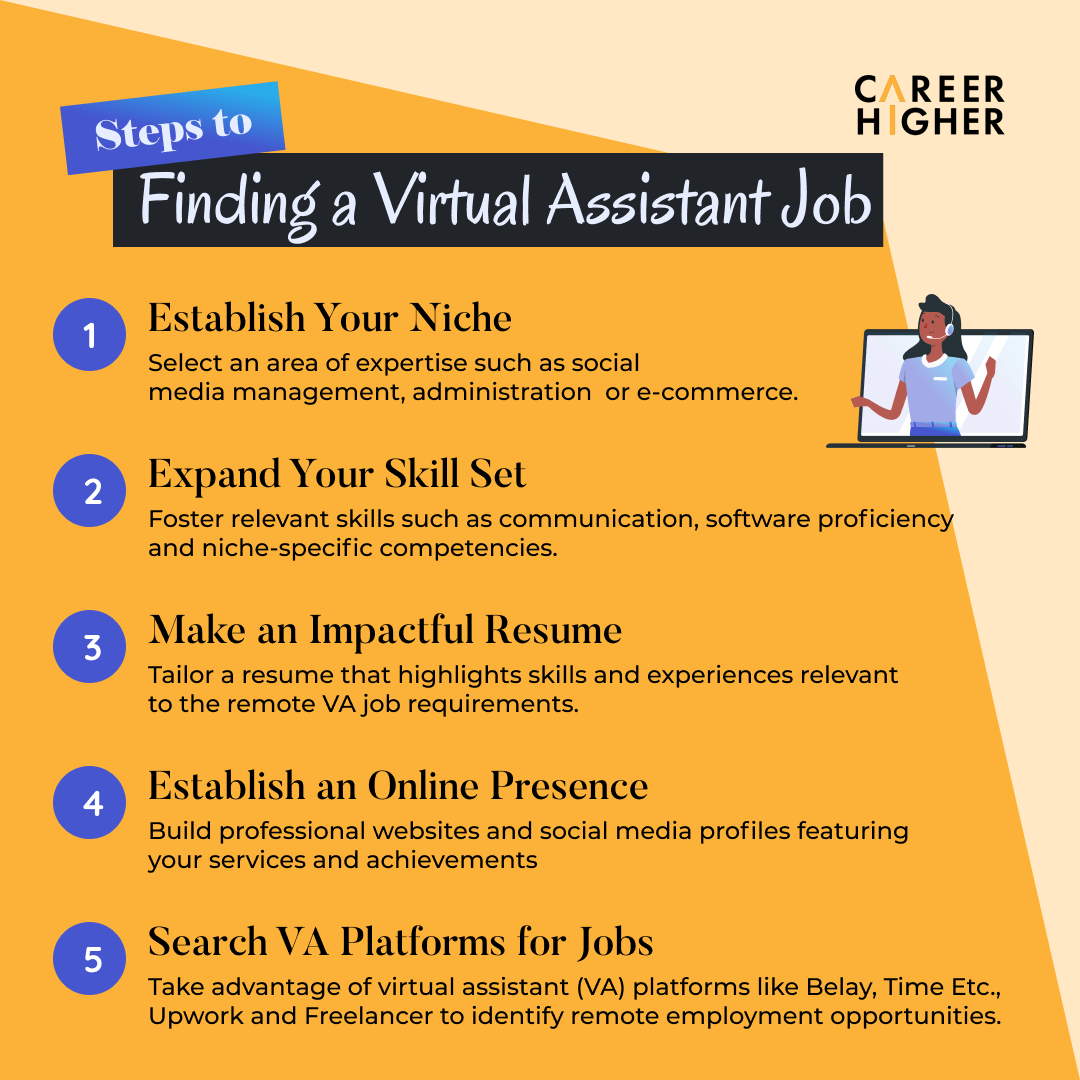

How to hire and vet a virtual assistant for bookkeeping

Hire slow and smart. Use a clear process to find someone reliable.

Steps to follow:

- Define tasks and hours. Write a short scope of work.

- Look for experience with your software and industry.

- Ask for samples or anonymized work examples.

- Give a paid test task. Test one simple reconciliation or report.

- Check references and ask about confidentiality.

- Start with a trial period and clear feedback loops.

Interview questions to use:

- Which accounting platforms do you use daily?

- How do you handle data security and backups?

- Tell me about a time you fixed an overdue reconciliation.

When you hire a virtual assistant for bookkeeping, document expectations. Clear task lists and weekly check-ins make the relationship work.

Pricing and cost savings

Pricing models vary. You will see hourly rates, monthly retainers, or per-task fees. A virtual assistant for bookkeeping usually costs less than a full-time bookkeeper when you factor benefits and overhead.

Cost examples:

- Part-time hourly: 10–20 hours per week at a set hourly rate.

- Monthly retainer: fixed scope and hours for predictable billing.

- Per-project: fixed fee for catch-up or cleanup work.

Simple savings math:

- Full-time hire cost = salary + benefits + office = high fixed cost.

- Virtual assistant for bookkeeping = flexible cost. You pay only for work done.

- For many small businesses, switching saves thousands per year.

Be transparent about expected deliverables. A clear scope helps you predict cost and measure ROI.

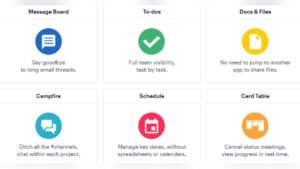

Tools and software to pair with a virtual assistant for bookkeeping

Pick tools that match your business and your assistant’s skills. The right stack speeds work and reduces errors.

Core tools to consider:

- Cloud accounting software for live books.

- Secure file storage for receipts and documents.

- Time tracking or task boards to monitor work.

- Bank feeds and automation tools for faster reconciliations.

- Invoicing and payment processors for AR.

Integration tips:

- Grant the minimum access needed to do the job.

- Use two-factor authentication on all accounts.

- Automate recurring items like invoices and bill payments.

When you onboard a virtual assistant for bookkeeping, set up shared dashboards. This keeps both of you aligned on tasks and priorities.

Security, compliance, and data protection

Security must come first. A loose process risks data leaks or misfiling. Plan controls from day one.

Key security steps:

- Use strong passwords and two-factor authentication.

- Sign an NDA and a data protection addendum.

- Limit account permissions to only what is needed.

- Require secure file sharing and encrypted storage.

- Keep backups and version control for important files.

Compliance notes:

- Follow local tax and payroll rules for your region.

- Keep records for required retention periods.

- Ask your assistant about experience with audits and record requests.

A trusted virtual assistant for bookkeeping will welcome these safeguards. They protect both your business and their work.

Onboarding, workflows, and best practices

A short onboarding makes a big difference. Clear workflows reduce errors and speed productivity.

Onboarding checklist:

- Share a task list and priority matrix.

- Give access to software with a sandbox account if possible.

- Provide chart of accounts and bookkeeping policies.

- Show examples of how you want reports to look.

- Schedule regular weekly check-ins for the first 60 days.

Workflow tips:

- Break tasks into daily, weekly, and monthly packs.

- Use a shared task board for transparency.

- Create templates for recurring tasks and emails.

- Keep a short how-to doc for common tasks.

These steps let your virtual assistant for bookkeeping start strong and stay efficient.

Common mistakes and how to avoid them

Avoid costly oversights with simple rules. Many problems come from poor expectations or bad access control.

Common mistakes:

- Vague scope of work that leads to missed tasks.

- Too much access without limits.

- No test task during hiring.

- Treating a virtual assistant for bookkeeping like a one-off fix.

- Skipping regular reviews and reconciliations.

How to avoid them:

- Write a clear task list and review it weekly.

- Use role-based access and rotate passwords if needed.

- Start with a paid trial and scale up based on results.

Preventing these issues saves time and keeps your books reliable.

Personal case study and lessons learned

I once hired a virtual assistant for bookkeeping to save time during a product launch. The assistant handled daily reconciliations and invoicing. This freed our team to focus on sales. The result was cleaner cash flow and no missed payments.

Lessons I learned:

- Test tasks before committing. The trial showed real skill differences.

- Document everything. A short SOP cut training time by half.

- Communication beats micromanagement. Daily 10-minute check-ins prevented small errors from growing.

A virtual assistant for bookkeeping can be a game changer when you treat them as a partner.

Frequently Asked Questions

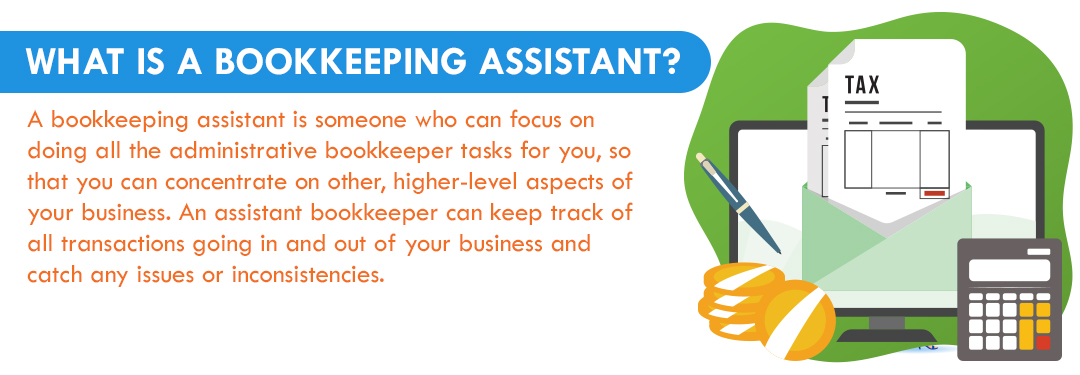

What is a virtual assistant for bookkeeping and how do they differ from a bookkeeper?

A virtual assistant for bookkeeping is a remote professional who handles accounting tasks. They often work part-time or on a contract basis and focus on routine bookkeeping rather than full accounting strategy.

Can a virtual assistant for bookkeeping handle payroll and taxes?

Yes, many can handle payroll data entry and basic tax prep tasks. Complex payroll or tax filings may require oversight from a certified professional.

How do I ensure data security when working with a virtual assistant for bookkeeping?

Use limited account permissions, two-factor authentication, encrypted file storage, and an NDA. Regular audits and secure password practices further protect data.

How quickly can a virtual assistant for bookkeeping start delivering value?

You can see value in as little as one week for routine tasks. Clean-up or catch-up work may take longer depending on the backlog.

What should I pay a virtual assistant for bookkeeping?

Rates vary by experience and region. Expect a range of hourly or monthly retainer fees. Set clear tasks and measure output to gauge fair pay.

Conclusion

A virtual assistant for bookkeeping can cut costs, reduce stress, and keep your finances tidy. Start with a clear scope, a paid trial, and strong security rules. Use simple tools and steady communication to make the relationship work. Take action today: outline the tasks you want to delegate, post a short job, and run a small paid test to find the right match. If this guide helped, leave a comment or share your experience below.

Sofia Grant is a business efficiency expert with over a decade of experience in digital strategy and affiliate marketing. She helps entrepreneurs scale through automation, smart tools, and data-driven growth tactics. At TaskVive, Sofia focuses on turning complex systems into simple, actionable insights that drive real results.