High education costs are on the rise. This growing expense worries many families.

The dream of a college education often comes with a hefty price tag. Tuition fees, textbooks, and living expenses add up quickly. For many, the financial burden feels overwhelming. Why are education costs so high? What can families do to manage these expenses?

In this blog post, we will explore the factors behind the rising costs of higher education. We will also look at possible solutions and strategies to help manage these expenses. Understanding the reasons behind the high costs can help families plan better and make informed decisions. Let’s dive into the details and uncover ways to make education more affordable.

Rising Tuition Fees

The cost of higher education keeps rising. Tuition fees have become a burden for many. Students and families feel the pressure. What are the reasons behind these rising costs? How do they impact the lives of students and their families?

Factors Driving Increase

Several factors drive the increase in tuition fees. First, colleges face higher operational costs. Salaries, utilities, and maintenance expenses are rising. Second, funding from the government has decreased. Schools need to make up for this shortfall. Third, there is a growing demand for higher education. More students mean more resources are needed. Lastly, schools invest in new facilities and technology. These investments come with a high price tag.

Impact On Students And Families

Rising tuition fees impact students and families greatly. Many students take on large loans. They graduate with significant debt. This debt can take years to repay. High costs also make college less accessible. Some students may choose not to attend. Families have to make tough financial decisions. They might have to cut back on other expenses. This can cause stress and financial hardship.

The emotional toll is also high. Students worry about their financial future. Families feel anxious about supporting their children. These pressures can affect mental health. Rising tuition fees are a serious issue. They shape the lives of many in profound ways.

Credit: www.salon.com

Financial Aid Options

Pursuing higher education can be expensive. Many students need financial aid. This section explores various Financial Aid Options to help manage costs.

Grants And Scholarships

Grants and scholarships are the best options. They do not need to be repaid. Grants are often based on financial need. Scholarships are usually awarded for academic, athletic, or artistic achievements. Some organizations offer scholarships for community service or leadership skills. Check with your school’s financial aid office for available grants and scholarships.

Student Loans

Student loans must be repaid with interest. There are two main types: federal and private. Federal loans often have lower interest rates. They also offer flexible repayment options. Private loans come from banks or other financial institutions. They may have higher interest rates. Compare different loan options to find the best fit for your needs.

| Type | Repayment | Interest Rate |

|---|---|---|

| Federal Loans | Yes | Low |

| Private Loans | Yes | High |

Savings Plans

High education costs can be overwhelming. Savings plans help families prepare for these expenses. Start saving early to ease the financial burden.

College costs are rising. Many families worry about affording higher education. Thankfully, savings plans can help. These plans offer tax benefits and growth potential. Let’s explore two popular options.529 College Savings Plans

529 plans are popular. They offer tax-free growth. You can use the money for tuition, fees, and books. They are flexible. You can transfer funds to another family member if needed. Contributions may be tax-deductible in some states. Start early to maximize growth.Coverdell Education Savings Accounts

Coverdell Education Savings Accounts (ESAs) are another option. They offer tax-free growth. You can use the money for K-12 and college expenses. ESAs have a $2,000 annual contribution limit. Withdrawals are tax-free for qualified expenses. They provide more investment choices than 529 plans. These accounts can help cover a wide range of educational costs. “`Budgeting For College

Budgeting for college is essential for managing high education costs. With proper planning, students can achieve financial stability and focus on their studies. A detailed budget helps to track expenses and identify areas to save money.

Creating A College Budget

Start by identifying all sources of income, such as scholarships, grants, and part-time jobs. List your fixed expenses like tuition, rent, and utilities. Also, include variable costs such as food, books, and transportation.

| Expense Category | Monthly Cost |

|---|---|

| Tuition | $500 |

| Rent | $700 |

| Utilities | $100 |

| Food | $250 |

| Books | $100 |

| Transportation | $50 |

Sum up these costs to understand your total monthly expenses. Compare them with your income. This will help you find out how much you can save each month.

Cutting Unnecessary Expenses

Once you have a budget, look for areas to cut back. For instance, cooking at home is cheaper than eating out. Use campus resources like libraries to save on books and study materials.

- Share housing with roommates to reduce rent costs.

- Use public transportation or a bicycle to save on travel.

- Buy used textbooks or digital versions instead of new ones.

- Limit luxury expenses such as dining out and entertainment.

Small savings can add up over time. Track your spending regularly to stay within your budget. Adjust your budget as needed to ensure you are not overspending.

Part-time Work

High education costs are a major concern for many students. Part-time work can help ease the burden. It offers flexibility and extra income. Students can find many opportunities to work while studying.

On-campus Jobs

On-campus jobs are convenient for students. They save time and money on travel. These jobs include positions in the library, cafeteria, and administrative offices. Students can also become teaching assistants. These jobs are usually flexible with class schedules. They also provide valuable work experience.

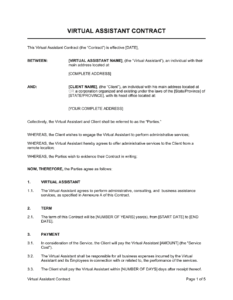

Freelancing And Gig Economy

Freelancing offers many opportunities for students. They can work from anywhere. It suits those with skills in writing, graphic design, or coding. Websites like Upwork and Fiverr connect freelancers with clients. The gig economy is also growing. Students can take on short-term jobs. These can include tasks like delivery services or dog walking. Gig jobs are flexible and can fit around study schedules.

Credit: www.wsj.com

Community College Pathway

The rising cost of higher education is a concern for many students and parents. One solution to this problem is the Community College Pathway. This route offers an affordable start to higher education. Students can save money and still achieve their academic goals.

Benefits Of Starting At Community College

Starting at a community college has many benefits. First, the tuition is much lower than at four-year institutions. This helps students save money on their education.

Community colleges also offer flexible schedules. Many students work part-time jobs while attending classes. This flexibility makes it easier to balance work and study.

Another benefit is smaller class sizes. Students get more attention from instructors. This can lead to better learning outcomes and higher grades.

Community colleges also provide strong support services. These include tutoring, career counseling, and academic advising. These services help students succeed in their courses and plan their futures.

Transferring To A Four-year Institution

Many students start at community college and then transfer to a four-year institution. This pathway allows them to complete general education requirements at a lower cost.

Transferring to a four-year institution is a common goal. Many community colleges have agreements with universities. These agreements ensure that credits transfer smoothly.

Students should work closely with academic advisors. This helps them choose the right courses. It also ensures that they meet transfer requirements.

Below is a table that compares the costs of starting at a community college versus a four-year institution:

| Cost Factor | Community College | Four-Year Institution |

|---|---|---|

| Tuition (per year) | $3,500 | $10,000 |

| Books and Supplies | $1,200 | $1,500 |

| Room and Board | $5,000 | $8,000 |

| Total (per year) | $9,700 | $19,500 |

The table shows the significant savings of starting at a community college. These savings can make higher education more accessible.

Overall, the Community College Pathway is a smart choice. It helps students save money and achieve their academic goals. It also provides a strong foundation for future success.

Online Learning

Online Learning has become a popular alternative to traditional education. It offers flexibility and affordability for many students. With the rise of technology, accessing quality education from home is now easier than ever. Let’s explore the benefits of online learning, focusing on cost-effective programs and balancing studies with work.

Cost-effective Online Programs

Many online programs offer significant savings compared to traditional in-person classes. These programs often have lower tuition fees. Students can save on commuting, housing, and other on-campus expenses. Here’s a quick comparison:

| Expense | Traditional | Online |

|---|---|---|

| Tuition Fees | $20,000/year | $10,000/year |

| Housing | $8,000/year | $0 |

| Transportation | $2,000/year | $0 |

Online programs also provide a wide range of financial aid options. Scholarships, grants, and payment plans are available. This makes education accessible to more students. The flexibility of online learning allows students to continue working while studying.

Balancing Online Learning With Work

Balancing work and study can be challenging. Online learning offers the flexibility to manage both. Here are some tips for success:

- Create a Schedule: Set aside specific times for studying each day.

- Communicate with Employers: Inform your employer about your study schedule.

- Stay Organized: Use tools like calendars and planners to keep track of deadlines.

- Take Breaks: Avoid burnout by taking regular breaks.

Many online programs offer part-time options. This allows students to spread their coursework over a longer period. Balancing work and study becomes easier. Support services like tutoring, career counseling, and tech support are available. These resources help students succeed.

Credit: acei-global.org

Employer Assistance

High education costs are a significant concern for many students. One way to ease this financial burden is through employer assistance. Employers often offer programs to help their employees with tuition and other education-related expenses.

Tuition Reimbursement Programs

Many companies provide tuition reimbursement programs. These programs cover some or all of an employee’s tuition fees. Employees can take courses related to their job. After completing the course, the company reimburses the cost. This helps employees improve their skills without incurring debt.

Tuition reimbursement can also motivate employees to stay with the company. It is a win-win situation. Employers get a more skilled workforce. Employees receive education without the financial strain.

Employer-sponsored Scholarships

Some employers offer scholarships to their employees or their employees’ children. These scholarships can cover tuition, books, and other educational expenses. Employer-sponsored scholarships often have fewer applicants. This increases the chances of receiving the scholarship.

These scholarships can be a great relief for families. They reduce the financial burden of education. Employees feel valued and supported by their employers. In turn, employers foster loyalty and retain talented workers.

Frequently Asked Questions

What Are The Main Factors Driving High Education Costs?

The main factors include tuition fees, living expenses, textbooks, and administrative costs. Additionally, the need for advanced technology and facilities contributes significantly.

How Can Students Manage High Education Costs?

Students can manage costs by applying for scholarships, working part-time, and seeking financial aid. Budgeting and finding affordable housing are also crucial.

Are Online Courses Cheaper Than Traditional Education?

Yes, online courses are generally cheaper due to lower overhead costs. They also offer flexible scheduling, reducing travel and accommodation expenses.

What Role Does Government Funding Play In Education Costs?

Government funding can lower education costs by subsidizing tuition fees and providing grants. However, insufficient funding can lead to higher costs for students.

Conclusion

High education costs continue to challenge many students and families. Planning ahead is crucial. Seek scholarships and financial aid opportunities. Consider community college for the first two years. Explore work-study programs to gain experience and reduce costs. Online courses can also offer savings.

Stay informed and make smart financial choices. Education is valuable, but managing costs is essential. Every little bit helps. Save where you can. Invest in your future wisely.

Ms.Sultana brings over 16 years of expertise working with global Clients by providing different skills and Services. For the last 5 years working as an Affiliate marketer, specializing in high-ticket campaigns that drive exponential growth. She holds a degree in Computer Science and Engineering as well as achieved many more skills certificates from different institute/academies/Platform. As part of the Elite Global Marketing team, Sultana has helped clients generate millions in revenue through strategic partnerships, innovative funnels, and data-driven insights.